The moderator Isaac Gyamfi (far left), Managing Director of Solidaridad West Africa, and the panelists on stage, from left to right: Kwabena Assan Mends (founder and director Emfed Farms); Peter van Mierlo (CEO FMO); Brian Frimpong (managing partner Zebu Investment Partners); Peter Heijen (founder and director Lendahand), and Hazel Taylor (associate director Acumen)

The challenge of capital

Economists have calculated that 270 million smallholder farmers in Asia, Africa and Latin America need an investment of 200 billion dollars for sustainable agriculture. However, the group of smallholder farmers and agricultural SMEs who have no access to capital keeps growing. Capital terms do not match their agricultural business, their business is too big for microfinance programmes and too small for local banks. Many smallholders and SMEs receive no loans from banks and when they do, it is at a very high interest rate and at unfavourable conditions.

For Solidaridad, the challenge of improving access to capital and scaling up investments for agricultural SMEs is essential for sustainable and inclusive development. For that reason, we have gathered a panel of experts to deep dive into the challenges and opportunities for scaling up investments in smallholders and agricultural SMEs. The video below explains more about this challenge.

Variety of expertise on stage

Our panelists are experts from the fields of finance, investment and development: Peter van Mierlo (CEO of FMO), Peter Heijen (founder and director of Lendahand), Hazel Taylor (associate director of Acumen), Brian Frimpong (managing partner at Zebu Investment Partners), and Kwabena Assan Mends (founder and director of Emfed Farms).

In fact, Kwabena Assan Mends, whose Emfed Farms provides full farm management services to cocoa smallholders in Ghana, knows from firsthand experience how difficult it is for an SME to gain access to capital. He is one example of the so-called ‘missing middle’ that represents a thriving force for agricultural development in many countries.

The session was moderated by Isaac Gyamfi, managing director of Solidaridad West Africa. The session was also made interactive through the use of the app Mentimeter, through which the audience could easily give their answers to the audience questions. The results were directly visible on the large screen behind the panelists on the stage.

Feedback from the audience through the app Mentimeter was directly visible on the big screen

‘Perception, perception, perception’

When asked about the difficulties he had encountered when setting up Emfed Farms, Assan Mends named three main challenges: accessing the market for service provision, gaining capital, and labour mobilization. The last challenge is due to that many young people in Ghana are not interested in becoming farmers and prefer to move to the city in search of a job.

He had initially started out small with some of his own savings and in 2015 was able to join the Cocoa Rehabilitation and Intensification (CORIP) programme of Solidaridad in Ghana. For Kwabena, getting an investment in his business would mean that he would be able to speed up the break-even point and scale up his enterprise, hereby also reducing costs and improving the infrastructure at Emfed Farms.

Brian Frimpong, managing partner at Zebu Investment, has extensive experience with financing SMEs in various African countries and was able to hit the nail on the head of this challenge: it is all about ‘perception, perception, perception’.

“‘Agriculture is a punishment’ is what they teach you when you grow up in Ghana,’’ he shared with the audience, explaining that his perception changed when he got to Wall Street and began to read the statistics about Africa. The continent still has the most arable land and agriculture is the largest employer; but the idea of becoming a farmer is not attractive due to its skewed perception.

Panel in discussion

Changing risk perception – telling the good story

Brian Frimpong further mentioned two important elements at play in financing SMEs: facilitating technical assistance (capacity building, equipment provision, the right infrastructure in place), and finding the right partners with the right capacity to complement the work of the business. In addition, he also emphasized that it is essential that both investors and SMEs learn how to connect between themselves. For investors, it is important that SMEs learn how to package and sell their company well.

The importance of changing the current risk perception of investing in agriculture in African countries was also stressed by Peter van Mierlo, CEO of the Dutch entrepreneurial development bank FMO. According to Van Mierlo, whilst climate change is not helping matters, agricultural diversification across continents and sectors is ever more important. In his perception, the money is available but the challenge lies in how to get it to where it needs to go.

How do we change this unrealistically high risk perception? Van Mierlo emphasized that the good story often stays left untold. Working on the value chain and the supply chain, bringing the good African values into the discussion and not only focusing on the European values: these are some of the important elements to tell the good story about the value of agricultural investments in Africa.

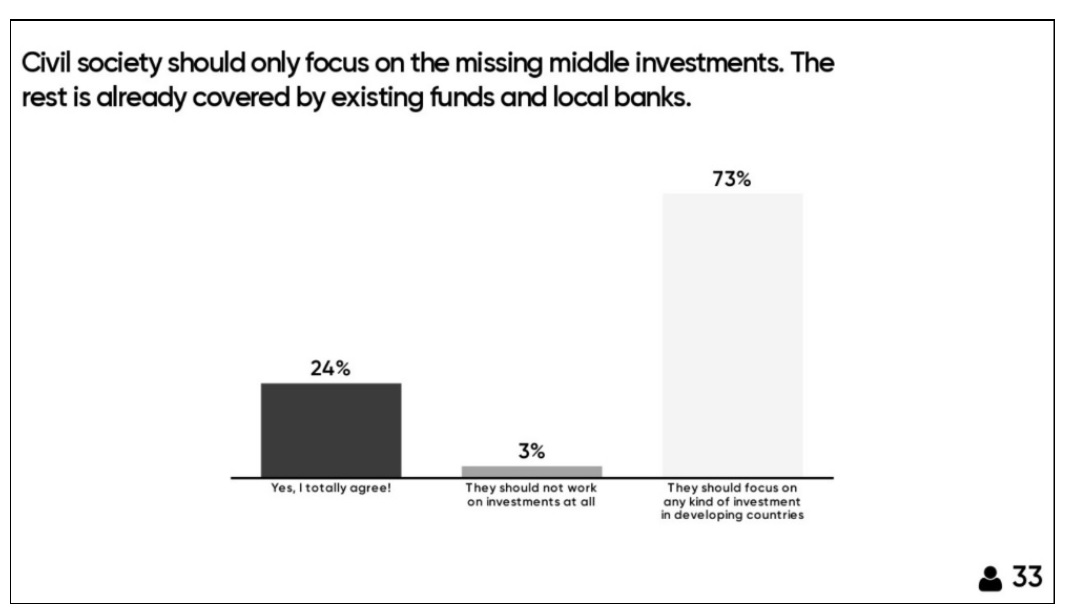

Audience results for the following statement were visible on the big screen behind the panelists

Van Mierlo was optimistic in his response but also gave a warning. He stated with confidence that Africa has a great future and we can help it flourish by bringing in investment money to speed up the process of growth and empowering local entrepreneurs. But we need to act now. Time is of essence and we do not have the time to wait with achieving the Sustainable Development Goals (SDGs), especially when it comes to tackling the two biggest global challenges in Van Mierlo’s view: climate change and inequality.

The role of private sector

The value of cross-sectoral cooperation was also put forward as essential. Hazel Taylor, associate director at Acumen, has shared her expertise on the subject of partnerships and emphasized the importance for impact investors to develop or facilitate partnerships with a wide range of stakeholders.

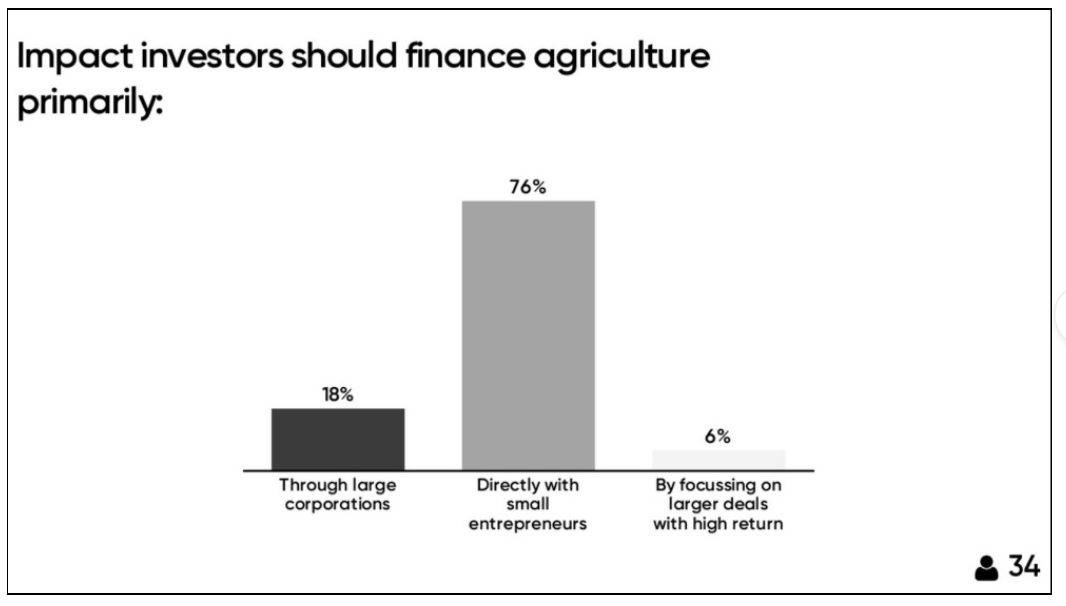

Audience results for the following statement were visible on the big screen behind the panelists

In response to the audience results regarding the statement who impact investors should primarily work with (see figure above), Taylor agreed that impact investors should mainly deal directly with small and early growth stage enterprises, as their business models tend to be highly innovative and proactively responsive to the needs of the farmer.

However, she stressed that it is also important to develop other relationships within the ecosystem to maximize impact. Investors should encourage entrepreneurs to have a strong feedback loop with their farmer-customers, to ensure business services meet their needs and deliver impact. Investors should also develop solid relationships with other funders and assist entrepreneurs to access different streams of capital. Technical assistance partners are key for capacity building of entrepreneurs and their employees. Larger corporates can be important partners as entrepreneurs scale, as they can harness their established infrastructure, such as supply chains and distribution means. Governments can also offer pathways to scale through infrastructure and public services. Many of these relationships can be brokered by engaged impact investors. According to Taylor, de-risking and scaling are crucial for success and often require a range of partnerships.

Financing the ‘missing middle’

Where it comes to financing the ‘missing middle’, Peter Heijen, founder and director of the crowdfunding platform Lendahand, saw a clear gap in the market during his work travels as a former banker in Bangladesh. Through Lendahand, he aims to direct private capital from individuals towards investments in SMEs.

How does it help to finance the missing middle? Heijen’s answer was both practical and in line with the reality anno 2019: Lendahand has been debt-funding SMEs in emerging markets for 5 years now, currently funding about 2 million euros per month. SMEs in need of funding find Lendahand, or Lendahand finds them in many ways. Sometimes these SMEs start googling and come across Lendahand in that way.

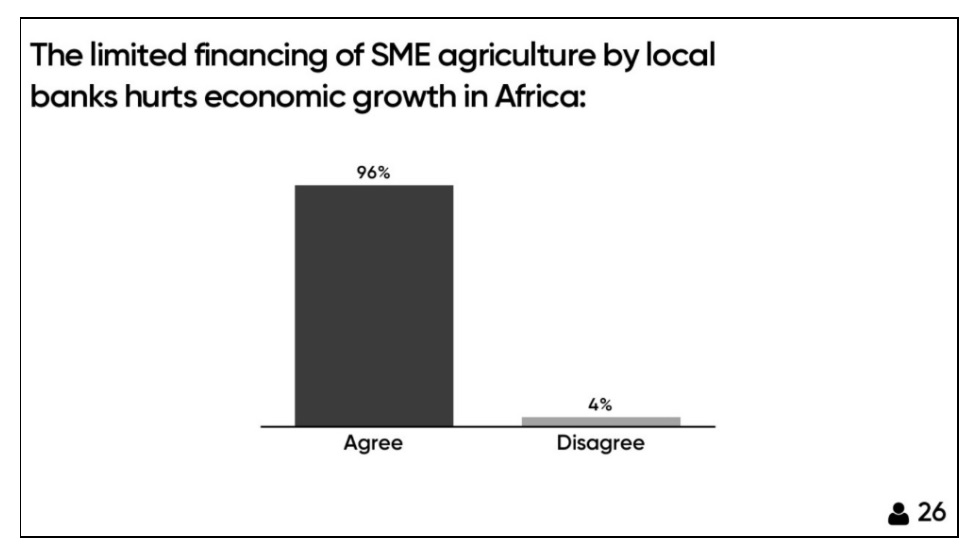

Heijen emphasized that it is difficult to finance SMEs and to make it profitable for banks. In his view, banks are not going to be the game changer and private capital is necessary. There is an enormous funding gap of 2.5 trillion dollars for the emerging economies – and that is not a simple challenge to tackle. Private capital is key to solving the problem and although it is challenging, we must find a way to help that capital trickle down to the people. Scaling and technology are necessary.

Audience results for the following statement were visible on the big screen behind the panelists

The role of blended finance and civil society

Despite the enormity of this challenge, the panelists were confident that there are plenty of opportunities to find good, workable solutions. In their concluding statements, both Hazel Taylor and Peter van Mierlo mentioned the importance of blended finance. Blended finance can help to affect the currently unrealistically high risk perception profile of investing in developing countries and emerging markets. This is an important challenge to tackle for scaling up access to finance for SMEs in these countries.

Van Mierlo shared that the world of blended finance is moving quicker than we might be aware of; for instance, the European Union plans to make 60 billion euros available through blended finance.

In his concluding statement, Brian Frimpong also shared that co-developing platforms with other investors and partnering to find innovative ways to carry out transactions and de-risk can contribute to achieving more impact.

The important role of civil society organizations was also emphasized by the panelists. Civil society and non-profit organizations can facilitate and accelerate the learning process for all stakeholders involved. They can also contribute through working directly with the SMEs on the ground, linking entrepreneurs to investors. Moreover, they can help to put pressure on governments by advocating for policy-level changes which are required to allow for more capital for lending (bankers need to understand SMEs better) and to enable capital to flow more freely between countries.

You can read more about Solidaridad’s 50th anniversary conference in this article.