Cooperative enterprises are broadly categorized as financial and non-financial. Financial cooperatives are generally defined as financial or other institutions that are fully owned and operated by individuals who hold membership in those institutions. They are incorporated with the objective of collecting funds (savings and deposits) from their members to deliver financial intermediation services that benefit their members. Such intermediation services may include investments, saving solutions, provision of credit among other financial services. On the other hand, non-financial cooperatives focus less on mobilization of deposits or funds and more on the welfare issues of their members.

Across Africa, Savings and Credit Cooperatives (SACCOs) are the fastest growing and vibrant type of cooperative. In comparison with traditional banking, SACCOs generally have no charges attached to the savings, however interest is payable on accumulated savings. In addition, members cannot access their savings unless they apply for credit or terminate their membership. Other types of cooperatives include housing, investment, marketing, production, and transport cooperatives.

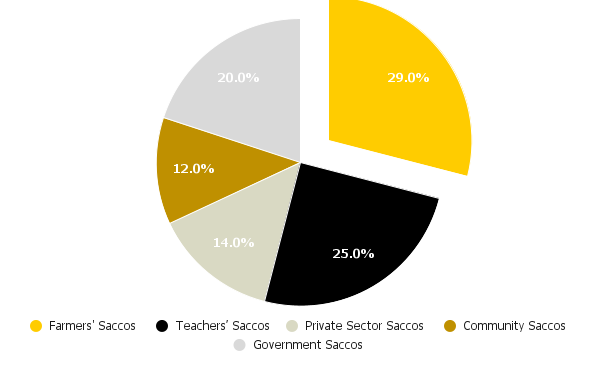

According to the Central Bank of Kenya Financial Sector Stability Report (2019), Kenyan SACCOs were controlling about 5.7% of total assets to gross domestic product (GDP) ratio. Kenya is followed by Rwanda and Ethiopia SACCOs which control 3% and 0.7% of the GDP respectively. Data from the SACCO Subsector Demographic Study Report (2019) showed that the deposit-taking SACCOs in Kenya were serving about 4.97 million individuals as at December 2018. Of the 4.97 million, 4.78 million were individual members while the rest were legal parties/institutions.SACCOs are classified into five general clusters, according to their common bond, specifically: i) government; ii) community-based; iii) private sector; iv) farmer; and v) teachers. The common bond is interlinked with a goal to strengthen economies as well as empower members with ownership over their financial means. The report further revealed that farmer-based deposits-taking SACCOs were the majority at 29% of the 172 registered SACCOs as shown below (Figure 1).

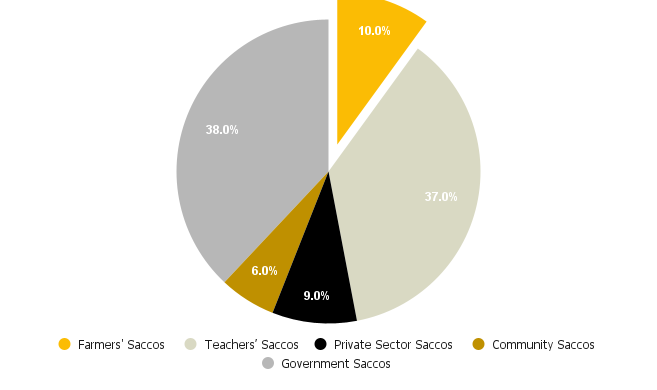

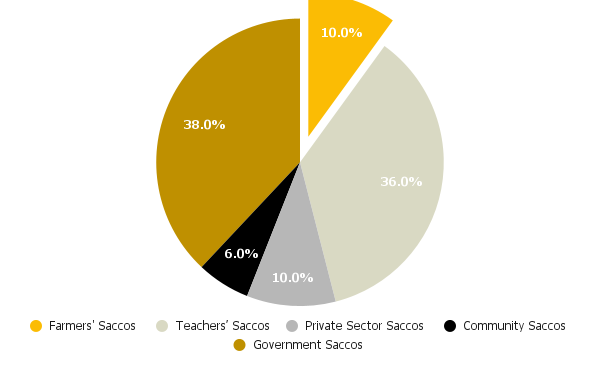

In Kenya, government SACCOs are the largest with assets worth Ksh 211.55bn (Euro 1.65bn) and deposits of Ksh 144.57bn (Euro 1.13bn). Teachers’ SACCOs are second with an asset base of Ksh 205.98bn (Euro 1.61bn) and Ksh 136.96bn (Euro 1.07bn) in deposits, while farmer SACCOs are third with an asset base of Ksh 55.67bn (Euro 0.44bn) and deposits worth Ksh 38.04bn (Euro 0.30bn). Private sector SACCOs come fourth with assets worth Ksh 50.10 (Euro 0.39bn) and deposits of Ksh 38.04bn (Euro 0.30bn) while community SACCOs rank fifth with assets worth Ksh 33.4bn (Euro 0.26bn) and Ksh 22.83bn (Euro 0.18bn) in deposits.

The SASRA Annual SACCO Supervision Report (2019) classified teachers’ SACCOs as the fastest growing, in terms of total assets and deposits. Despite agriculture being the backbone of the country’s economy and farmers’ SACCOs dominance in numbers, they are unable to rival government and teachers’ SACCOs in terms of assets, market share and total deposits. This is attributed to sub-optimal marketing structures, limited leadership and management capacities. Farmers’ SACCOs are also characterized by a weak capital base which is linked to their members’ irregular/unstable income in comparison to stable incomes and check offs systems in government and teachers’ SACCOs.

Strength in numbers

Cooperatives are an important vehicle that enables farmers to pool financial and technical resources thus spreading their costs and drawing from the collective members’ experiences. In sub-Saharan Africa, cooperatives enhance farmers’ access to credit, information on markets, and production practices. Importantly, cooperatives increase access to high-quality farming inputs, bargain on behalf of members, provide transportation services, and market produce on behalf of members. Considering farmers make significant upfront investments from time to time, cooperatives play a critical role in enabling farmers to hire expertise and acquire value-adding assets. For rural smallholders who often face major financial constraints, cooperatives provide a means to attain adaptability and resilience—two things most farmers consider essential.

Unlocking the potential of farmers in East and Central Africa through cooperatives

In East and Central Africa, Solidaridad is working with more than 1,000 cooperatives including Oromia Coffee Farmers Cooperative Union in Ethiopia and Katheri Dairy Farmers Cooperative in Kenya.

Our goal is to strengthen the capacity of the cooperatives to enable them to offer quality services to smallholder farmers (more than 100,000 cooperative members). The services include the provision of farming inputs, extension services, training on agronomy and animal husbandry best practices, linkages with markets and input providers as well as service providers (financial and insurance).

Through our inclusive programming, we also strive to foster effective credit risk management, as well as enhance leadership capacities to enable the cooperatives to maximize opportunities for growth while minimizing risks, such as inefficient use of resources.

Moreover, Solidaridad supports the cooperatives to be more competitive through the enhancement of internal controls and promoting the adoption of effective technologies including the Dairy Management System, Farmer Solution and soil testing among others.

Solidaridad also offers financing solutions for small and medium-sized enterprises (SMEs) and SACCOs for on-lending components to members through PlusPlus, a crowdfunding platform. Since August 2020, PlusPlus has disbursed Euros 214,950 (Kshs 27, 506,915) in East Africa, benefiting about 1,058 smallholder farmers. The solution offers competitive debt for both working capital and asset financing to boost SMEs’ and cooperatives’ capital.

While not all cooperatives are equally good, many offer quality services to farmers at competitive rates. Financing and supporting cooperatives that are transparent, inclusive, demonstrate a solid entrepreneurial management style, and adopt value-adding technologies will go a long way in unlocking the full potential of smallholder farmers in East and Central Africa.