Key findings:

- Synthetic fibres are growing at the expense of cotton: Fast Fashion giant, Shein, now sources 82% synthetic fibres.

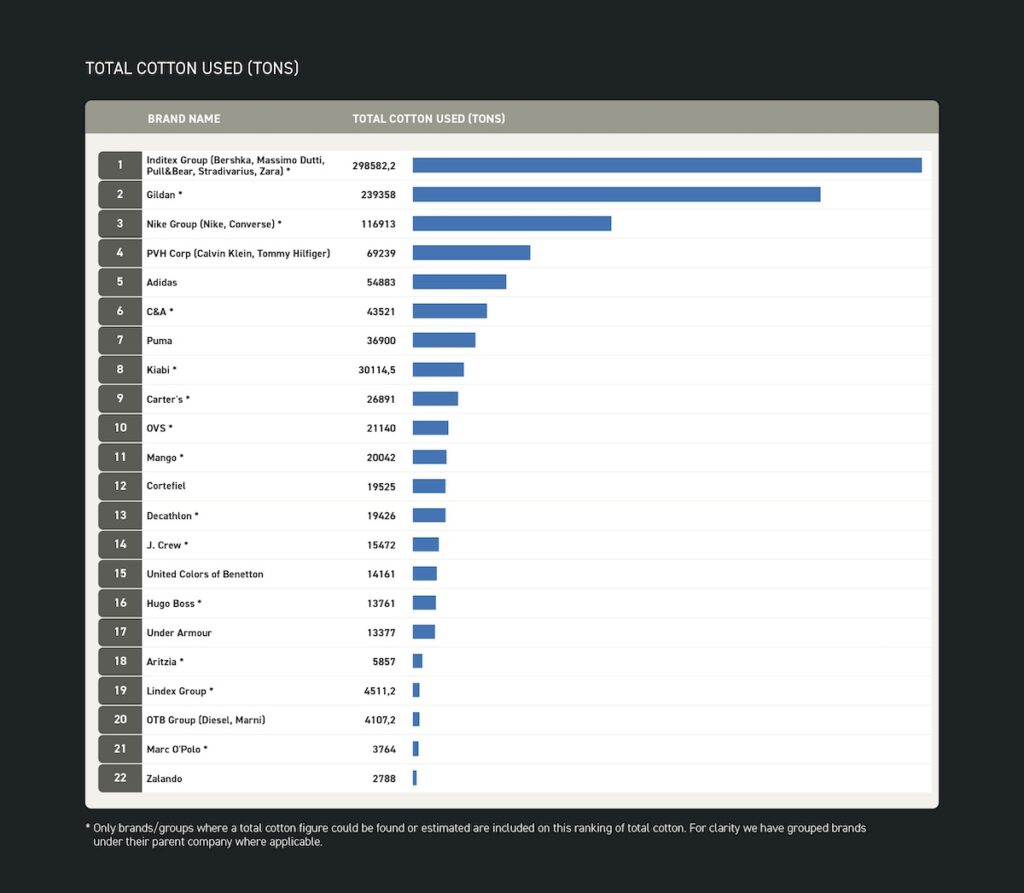

- Even brands with high certified cotton shares often use very little cotton overall — meaning the impact is far smaller than their claims suggest.

- Only 29 of the world’s top 100 fashion brands disclose how much cotton they use.

- Just 35 provide information on the type of certification — and only 25 publish a full material breakdown.

Two thirds of the companies operate in the dark

Created in partnership with Good On You, the leading sustainability ratings platform for fashion and retail, the latest edition of the Cotton Rankings provides a fresh perspective on the use of cotton by the biggest fashion brands. Readers can now see how brands rank not only in terms of share of certified cotton but also total volume of cotton used, and how this compares with their use of synthetics.

“What makes this partnership powerful is how Good On You’s sustainability assessments, including deep analysis of material sourcing and certification claims, complement Solidaridad’s focused cotton expertise, revealing patterns invisible in traditional reporting.”

Sandra Capponi, co-founder at Good On You.

The rankings also find that most brands still fail to disclose basic data about their cotton sourcing. By promoting the use of ‘sustainable fibres’ without information on total volumes used, consumers and researchers are unable to verify sustainability claims. This means that over two-thirds of the global fashion market is effectively operating in the dark when it comes to one of its most critical raw materials.

Cotton is losing ground to synthetic fibres

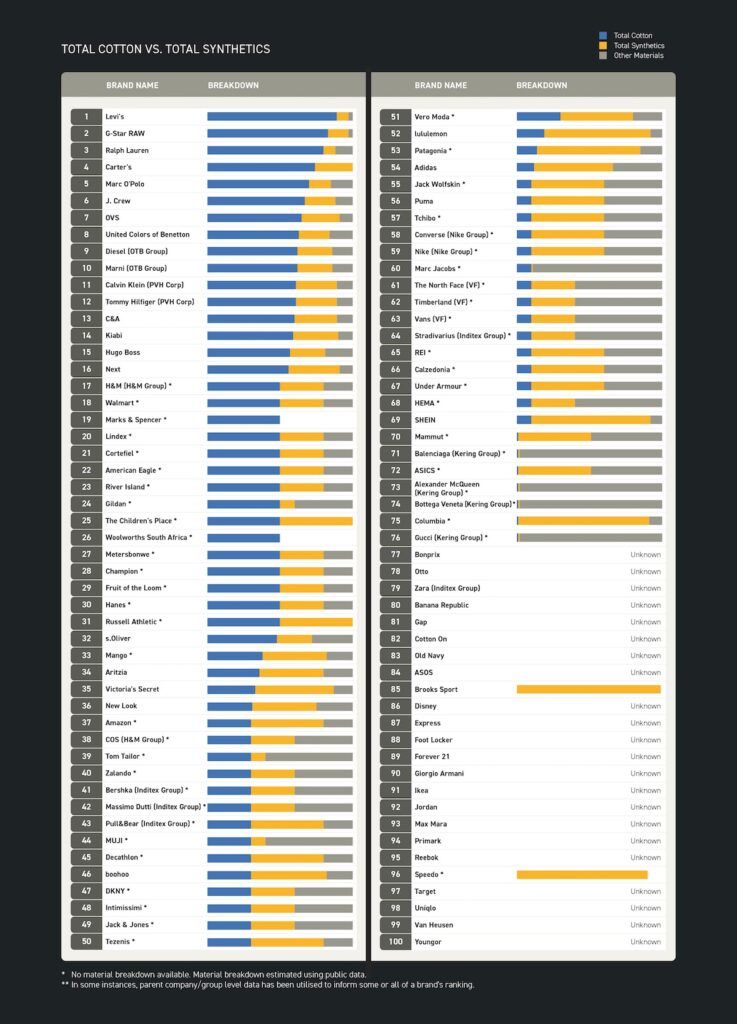

The 2025 Cotton Rankings find that synthetics continue to gain in prominence. Although cotton remains a critical component for roughly half of the brands analyzed, synthetic fibres make up a considerable share.

- Just 31 of the companies ranked use 50% cotton or more in their operations and of these just 17 of them claim that more than 50% of their cotton is certified.

- 26 brands rely on over 50% synthetic fibres.

- 43 brands use a wider mix of different fibres, natural and synthetic.

Particularly alarming is the scale of synthetic dependence among market leaders. Fast fashion giant Shein, whose global market share now surpasses H&M and Zara, sources 82% of its fibres from synthetics. This over-reliance on fossil-fuel fibres locks the sector into an unsustainable trajectory, while greater investment in cotton and other natural fibres could instead support a climate-positive supply chain.

“The fashion industry has a choice: double down on fossil-fuel fibres or unlock cotton’s potential as a force for good.”

Tamar Hoek, policy advisor at Solidaridad Network

“The fashion industry has a choice: double down on fossil-fuel fibres or unlock cotton’s potential as a force for good,” says Tamar Hoek, policy advisor at Solidaridad. “Brands can do this today by leveraging their vast resources to purchase certified cotton and by investing in smallholder cotton farmers through support programmes and fair purchasing practices.”

Progress on certified cotton is slow

While a direct comparison between the 2023 ranking and 2025 is not possible, as this ranking deals with many more brands, a cursory glance suggests that progress on certified cotton sourcing has been negligible. Only 31 brands use more than 50% cotton in their overall fibre mix – and just 17 of those claim over 50% of it is certified. This reveals a critical gap between ambitious claims and actual impact: many brands with high percentages of certified cotton use barely any cotton overall, while many of those with a heavy reliance on cotton usually use uncertified cotton.

25 brands report recycled cotton in their supply chain, but the percentage of recycled cotton for 12 of these brands is negligible, reported at about 1%. Yet this trend toward circularity in cotton sourcing remains encouraging.

Urgent action needed now

Cotton can be a positive force when smallholder farmers are paid decently and able to adopt sustainable production practices. As it stands currently, low prices paid for cotton contribute to chronic issues, such as the overuse of agrochemicals, poor water management, and monocropping, which result in the loss of biodiversity, degraded soils, and other environmental challenges.

The power to change this dynamic lies with brands. Brands can make a first step by becoming more transparent about their purchasing practices and by prioritizing a shift to 100% certified cotton. Without urgent action from fashion brands, the sector risks losing cotton’s potential as a sustainable alternative – and locking itself into a future dominated by fossil-fuel fibres.

*All data used in these rankings were publicly available prior to June 2025. Data released after that date are not considered. In some instances, parent company/group level data has been utilised to inform some or all of a brand’s ranking.