REGIONAL COMMODITY PROGRAMMES

Although the current drought in Southern Africa has a negative effect on the production of cotton, Solidaridad and its partners are expanding Better Cotton production to South Africa. In Mozambique, the focus is now on increasing yields by grouping farmers in clusters with better support systems.

Solidaridad’s horticulture programme was formally established in January 2015 and a sector strategy was completed by October 2015 in line with the global multi-annual strategic plan. The overall focus of the strategy is to assist in the upskilling and commercialization of smallholder producers in the horticulture sector in Southern Africa. Solidaridad seeks to improve local and regional market integration and coordination along the horticulture value chain.

The year 2015 saw livestock continue its journey as one of the important focus commodities for Solidaridad Southern Africa. Solidaridad continued managing the two Dutch government-funded Farmer Support Program (FSP) livestock projects that will conclude in early 2016, while also exploring opportunities for new interventions beyond the FSP.

Solidaridad Southern Africa was involved in two soy projects: one through the National Smallholder Farmers’ Association of Malawi (NASFAM) and one in Mozambique through Technoserve. A programme for promoting responsible soy in Mozambique and Malawi was part of the Farmer Support Program which came to an end in October 2015.

The capacity of smallholder sugarcane farmers was strengthened through increased productivity, comprehensive training, organizational development, adoption of sustainable practices, improvements in bulk infrastructure, as well as increasing industry efficiency and competitiveness. This will contribute to reducing poverty by increasing incomes for smallholder sugarcane farmers.

DEVELOPMENTS

Falling global commodity prices dragged down economic growth in the countries in the region that are predominantly dependent on the export of minerals and natural-based commodities. In addition to that, the weakening value of the local currencies against the US dollar and other major global currencies, unclear and restrictive domestic policies, and continued adverse climate conditions (drought and floods) hindered the desired economic and social growth in the region. The weakened local currencies and electricity shortages also continued to put a strain on the regional economy. Electricity and water supply constraints hampered growth by both interrupting production and discouraging investment in the region.

South Africa experienced the worst drought in years. The agricultural sector contracted by 12.6%, the third straight reduction due to low production of field crops. Mozambique suffered from the effects of adverse weather that produced drought conditions in the south while causing flooding in the north of the country. This had a negative effect on field crops in a country that is highly dependent on rain-fed agricultural production.

For Zambia, 2015 was a turbulent year. A downward trend in copper prices and adverse weather conditions hindered Zambia’s growth prospects. Thousands of workers in the mining sector were rendered jobless in Zambia and South Africa as major mineral producers and processors scaled back operations.

Generally, there was an increased focus by national governments on promoting inclusive and sustainable growth. Smallholder farmers, and women and youth in particular, were increasingly prioritized as the future of agricultural and economic development in Southern Africa. Governments are working collaboratively to broaden opportunities for smallholder farmers in Agriculture and other economic sectors.

ACHIEVEMENTS

Solidaridad Southern Africa has evolved from an unstable and high staff turnover team to a stable team that rebuilt the image of Solidaridad in South Africa and the region. We also managed to normalize and improve performance as a team. We will continue to build our coherence, strengthen our weaknesses and increase our effectiveness in programme design and delivery.

During the year, links and relationships were initiated with new partners in the public and private sector including regional retail market chains (Spar, P&P, Shoprite, and Food Lover’s Market). Solidaridad started piloting the adaptation of Rural Horizons (RH) to the Southern Africa context and gained the interest of some the key players in the fruits, vegetables and sugarcane sectors.

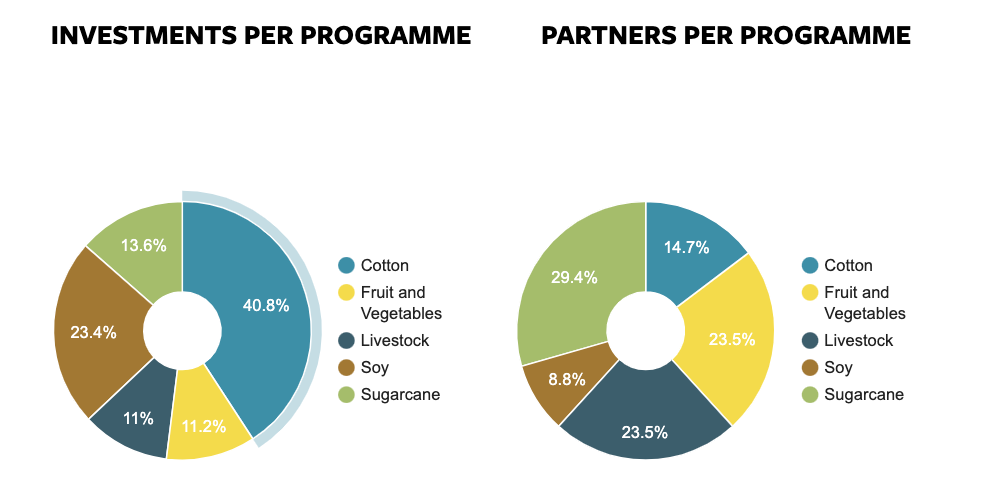

Commodity strategies (for cotton, fruits, vegetables, soy, livestock and sugarcane) and Solidaridad’s new multi-annual strategic plan (MASP) for the period 2016 – 2020 were a signficant result for 2015. Farmer Support Program funded projects were successful in Malawi (sugar, soy), Mozambique (cotton, soy), Namibia (livestock) and South Africa (livestock).

Solidaridad Southern Africa hosted the Africa Continental Supervisory Board meeting in May 2015, and participated in Solidaridad’s Executive Board of Directors meetings. Team members also participated in a number of network meetings including communications, finance, gender, Rural Horizons and commodity meetings.

Developing commodity strategies and the strategic plan provided a good learning experience and enhanced our understanding of internal systems and the external context in which we operate. Solidaridad Southern Africa also succeeded in developing proposals and accessing internal funding within the Solidaridad Network.

PARTNERSHIPS

The most influential partners and donors are outlined per sector as follows:

Cotton – Cotton South Africa, Cotton Association of Zambia, Cotton Board of Zambia National Cotton Producers Forum of Mozambique (FONPA Mozambique), Cotton Institute of Mozambique (IAM), OLAM, FAO, Joao Ferreira dos Santos (JFS), and Woolworth. Major sector donors include the Dutch government (RVO), the South African government (Provincial Department of Agriculture).

Horticulture – SPAR, Food Lovers Market (Fruit and Veg City retail chain), Pick and Pay (PnP) and Shoprite/Checkers. Solidaridad worked closely with the Southern Africa Food LAB (SAFL), WWF, LIMA, and the Deciduous Fruit Development Chamber (DFDC).

Livestock – Meatco in Namibia, Red Meat Producers’ Organization in South Africa, Swaziland Meat Industries, Botswana Meat Commission (BMC), UK based Global Protein Solutions (GPS) and Zambeef continued to be the most influential partners for livestock (beef) in the region, contributing to the much needed business model and co-funding. Like-minded entities such as the Savory Institute, Heifer International and WWF continue to be influential partners too. Of these partners, Zambeef, BMC and IFAD are the most promising new partners to work with.

Sugarcane – ILLOVO, TSB Sugar, TSGro (A subsidiary of TSB Sugar South Africa), The Dangote Group, Tongaat Hullett, UCL Company South Africa, Akwandze, Hippo Valley Estates (an Anglo-American subsidiary), Concern Universal, Noordsberg Canegrowers, Swaziland Sugar Association (SSA), South African Sugar Research Institute (SASRI), South African Sugar Association (SASA), Bonsucro, Sugar Association of Malawi and National regulatory bodies.

ORGANIZATION

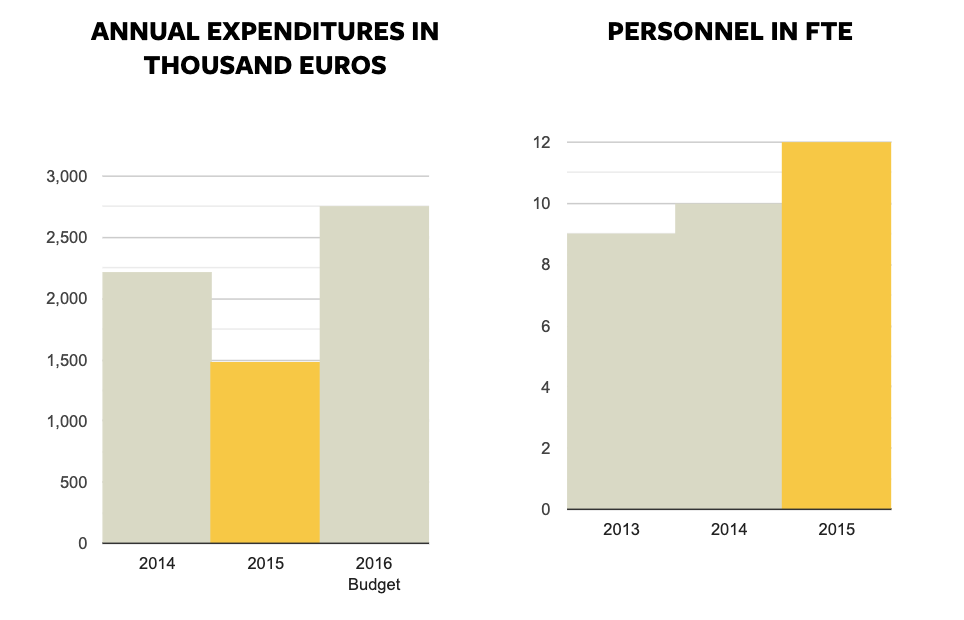

Key human resource changes included the recruitment of three programme managers (two in South Africa and one in Zambia) in January 2015, and the recruitment of a new managing director who replaced the interim director in May 2015.

Internally within the network, Solidaridad Southern Africa participated in Rural Horizons, gender, PME, finance, communications/collaborationn tools, and fruit & vegetable workshops. We also convened a smallholder horticulture workshop to discuss market access barriers.

Externally, the Solidaridad team participated and contributed in the Malawi National Sugar Conference, SUSFARMS planning and development meetings, the Sugarcane/Bonsucro conference in Brazil, and became a member of the Sustainable Cotton Cluster in South Africa.

During the year under review, Solidaridad Southern Africa officially registered Solidaridad’s presence in Mozambique and Zambia.