Central American agri-food needs increased access to finance

The Inter-American Development Bank estimates that micro-, small-, and medium-sized enterprises (MSMEs) make up more than 99% of all companies and employ 60% of the working population in the Latin American and Caribbean (LAC) region. Yet, data managed by the International Finance Corporation through the SME Finance Forum indicate that there is a $1,044,494 million finance gap for MSMEs in the LAC region.

At Solidaridad, we believe that sustained and inclusive economic growth can drive progress in developing countries like Nicaragua, Honduras and Guatemala. Meanwhile, development organizations like the United Nations Development Programme affirm that supporting productive small- and medium-sized enterprises (SMEs) can become the region’s motor of recovery following the COVID-19 crisis. However, access to finance so that Central American SMEs can grow, create more jobs and accelerate recovery from COVID is limited, particularly in the agri-food sector.

Why is financial access for agri-food SMEs limited in Central America?

On the one hand, agri-food companies pose a significant risk for traditional investors, especially those who depend on the supply of commodities, often produced by smallholder farmers who depend on favorable climate conditions. Further barriers to access capital include the ability to clearly demonstrate project viability and, very often, complex financial conditions such as collateral requirements and high financing costs. For those SMEs that can overcome these hurdles and access capital, additional challenges related to the fragile socio-economic context of the region often further hinder growth.

On the other hand, financial institutions often cite weaknesses in the business acumen and leadership of Central American SMEs as factors that contribute to rendering them unbankable to their standards. For example, many agri-food SMEs lack the technical knowledge to be able to communicate their vision and pitch their ideas for expansion. Financial professionals point to a generalized aversion to learning and applying best practices such as documenting company finances, fostering consistency in data collection and a commitment to strengthening investments. The lack of formalization in agri-food is a large component affecting their access to finance, as well.

Central American agri-food SMEs need flexible financing

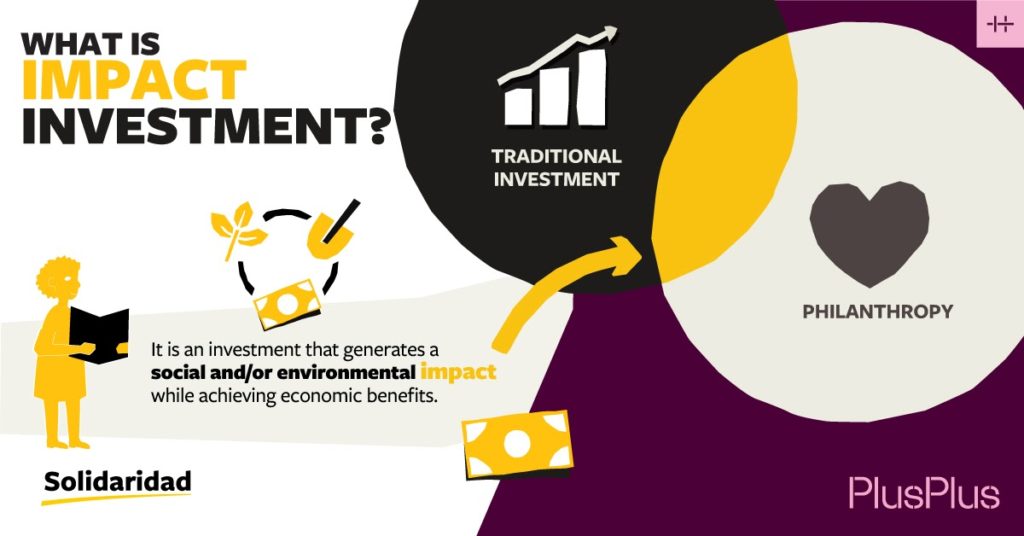

In a knowledge brief by the Global Accelerator Learning Initiative (GALI), authors concluded that there is “clearly a mismatch in the type of funds entrepreneurs need and the type of financing available” in Central America. Along with other suggestions, GALI authors recommended that “accelerators should carefully consider the profile of investors they are engaging and prioritize relationships with impact investors that are willing to work with riskier early-stage ventures”.

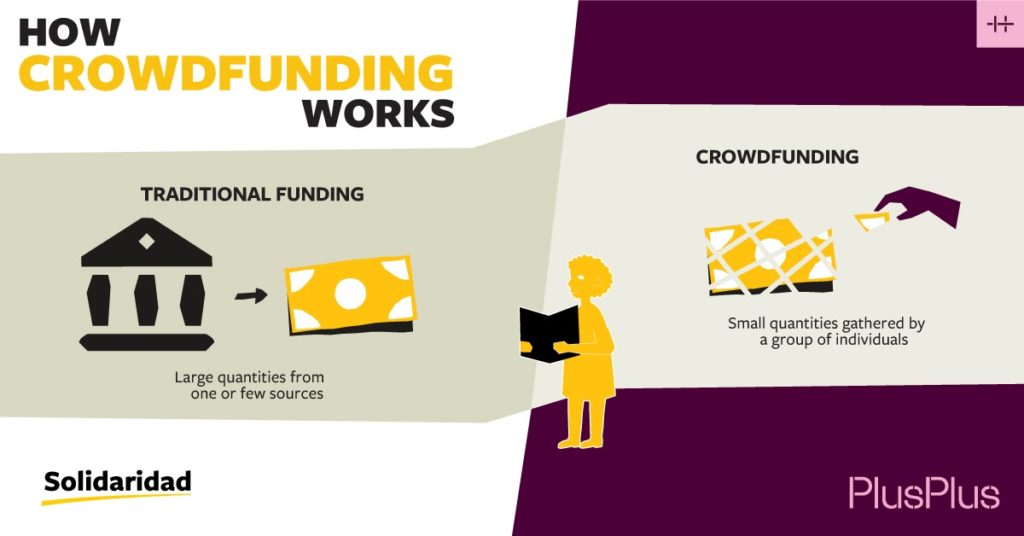

In 2020 we launched PlusPlus, a crowdfunding platform that provides flexible financing to SMEs in the agri-food sectors in Latin America, Asia and Africa. Solidaridad developed the platform with partners Cordaid, Lendahand and Truvalu to provide an innovative investment mechanism for individual investors in Europe who are interested in generating impact through their investments. To date, 32 entrepreneurs have had their projects fully funded on PlusPlus thanks to the finance provided by over 400 individual impact investors. These entrepreneurs are now experiencing firsthand how crowdfunding works as a flexible financing mechanism to increase working capital and/or capital expenditure in order to grow their business.

PlusPlus: Impact investing in sustainable production

Sustainable production can make a major contribution to the transition to low-carbon and green economies and to improving the living standards of everyone involved in the value chain. This is why in our initiatives, at Solidaridad we place special emphasis on training smallholder producers and workers in sustainable practices. We have also committed to supporting producers and the companies that represent them to access finance to transform production systems through sustainable agricultural and manufacturing practices. In May 2021, impact investors funded Fruvex’s project through PlusPlus. This was the platform’s first project in Central America.

PlusPlus facilitates social and environmental impact in Central America

Agri-food SMEs, like Fruvex, that are creating jobs, strengthening family income and strengthening the food system through sustainable practices, help to improve living standards and therefore contribute to the sustainable development of the region. Crowdfunding through PlusPlus brings together conscientious individual investors who are keen to make a difference through their investment decisions.

What is impact investment?

Impact investment refers to investments made into companies with the specific intention of creating measurable social or environmental impact, in addition to financial return. Companies seeking a loan through PlusPlus must fulfill a set of requirements regarding their business and impact model.

Annelies van der Vorm is a Dutch businesswoman and investor. In a recent PlusPlus blog, she stated that she learned from an early age to “live out of gratitude” and that by giving something of your wealth back to society, you can bring about a lot of change.

Giving a loan at PlusPlus is a way to give your money a lot of meaning, because it comes back to you and you can invest in a new entrepreneur again.

Annelies van der Vorm, PlusPlus Investor

Usually, impact investment is strongly tied to investors’ values and principles. For example, Arno Huibers discussed in another blog how well the platform’s vision aligns with his own.

The danger is that individuals and countries remain in the help mode…. in the end, everything must become independent. People have to be able to do without me. I see that reflected in PlusPlus as well. They are really focused on helping people develop themselves and their businesses.

Arno Huibers, PlusPlus Investor

PlusPlus provides entrepreneurs advisory services during the project preparation and analysis phase, supporting them to prepare their business and investment plans. During project implementation, PlusPlus accompanies entrepreneurs to ensure their projects stay on track and to measure results.

Can PlusPlus support my agri-food SME in Central America?

PlusPlus is a flexible mechanism for Central American agri-food SMEs to access capital. It sources funds from the crowd and uses locally based experts to support the analysis of SME business propositions. We will share more guidelines in another article coming soon.

Meanwhile, if you are interested in learning more about PlusPlus and how you could join us in strengthening food systems in Central America, please contact Lucette Martinez Pallais, the regional PlusPlus coordinator at lucette@solidaridadnetwork.org.

For more information

if you are interested in learning more about PlusPlus and how you could join us in strengthening food systems in Central America, please contact Lucette Martinez Pallais, the regional PlusPlus coordinator at lucette@solidaridadnetwork.org